As the tax season rolls around once again, many of us find ourselves grappling with the often daunting task of filing our returns. This year, I decided to tackle my tax responsibilities with a tool I’ve heard so much about: TurboTax Home & Business 2023. Designed specifically for the self-employed, freelancers, and small business owners, this software promises to simplify the often intricate world of taxes while ensuring we’re not leaving any money on the table. With its ability to search for deductions tailored to individual situations, TurboTax aims to boost our confidence when filing. In this review, I’ll take you through my personal experience with TurboTax Home & Business 2023, exploring its features, ease of use, and how well it delivers on its promises. Whether you’re a seasoned self-employer or just starting out, finding the right tax software can be a game-changer. From the initial download to the final e-filing, I’ll share the ins and outs—so you can decide if this product is the right fit for you this tax season. Let’s dive in!

Table of Contents

Navigating Tax Season with Ease: An Overview of TurboTax Home & Business 2023

Navigating Tax Season with Ease: An Overview

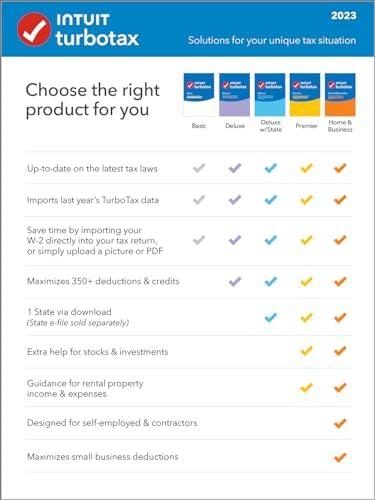

For individuals and small business owners, the tax season can often feel overwhelming. This software is designed to take the stress out of filing taxes by tailoring the experience to your specific situation. It diligently searches through hundreds of possible deductions and credits, ensuring you don’t miss out on any potential savings. Users will appreciate the ability to import information from previous software, making for a smoother filing process. Additionally, the software offers the convenience of 5 Federal e-files and a State file through download, with supplemental support available via free U.S.-based customer service—a welcome resource during tax season.

Whether you are self-employed, a freelancer, or managing a home-based business, this program equips you with the tools needed to maximize your deductions. Features such as industry-specific small business tax deductions and simplified asset depreciation allow for accurate reporting while minimizing errors. With the Audit Risk Meter included, you can proactively check your return for potential audit red flags. Moreover, the ability to create and e-file W-2s and 1099s directly within the software simplifies record-keeping for both you and your contractors. this software streamlines the tax preparation experience, making it accessible even for those new to filing taxes.

Unpacking the Features: What Sets TurboTax Apart for Home and Small Business Users

When considering tax software, the ability to cater to diverse user needs is essential. This program excels in this area, particularly for self-employed individuals and small business owners. It intelligently identifies hundreds of personal deductions and business credits tailored specifically to your situation, ensuring you can maximize your tax refund. This software presents a unique advantage with features like industry-specific small business deductions, making it invaluable for freelancers or independent contractors. Furthermore, users can seamlessly import information from previous tax returns or other software, providing a significant head start in the filing process.

Not only does this software streamline tax filing with its user-friendly design, but it also boasts robust support options. Users benefit from five federal e-files and one state return, with additional state e-filing available as needed. A standout feature is the Audit Risk Meter, designed to flag your return for potential audit triggers before submission, enhancing your peace of mind. Additionally, the ability to create and e-file W-2s and 1099s using Quick Employer Forms adds further efficiency for those managing employees or contractors. With free U.S.-based support available, it ensures that help is just a call away whenever required.

In-Depth Insights: Maximizing Your Tax Return with TurboTax Home & Business

In-Depth Insights: Maximizing Your Tax Return with TurboTax Home & Business

The latest tax software solution is designed for self-employed individuals and small business owners looking to optimize their tax returns. Notably, it performs a comprehensive search for hundreds of deductions and credits, ensuring that users can claim every dollar they deserve. With an intuitive interface, the software is ideal for those managing their finances through home offices or independent contracting. It allows for the easy import of previous tax data, enabling a seamless transition for returning users. The ability to create and e-file W-2 and 1099 forms streamlines payroll management, catering specifically to those employing contractors or staff. Furthermore, the embedded Audit Risk Meter provides an extra layer of security by identifying potential audit triggers before submission.

Another remarkable feature is the emphasis on industry-specific small business tax deductions, which can notably enhance one’s bottom line. Users can not only handle regular tax filing efficiently but are also guided through start-up costs that qualify for deductions. As tax laws can frequently change, this software ensures that users are up-to-date with the latest regulations, further minimizing the risk of errors through automated data imports from W-2s and investment records. The product supports five federal e-files and includes state filing options (available for an additional charge), reinforcing its value for comprehensive tax management.

| Feature | Description |

|---|---|

| Industry-Specific Deductions | Find targeted deductions relevant to your business type. |

| Audit Risk Meter | Identifies potential audit triggers before filing. |

| W-2 & 1099 Filing | Easily create and e-file necessary tax forms. |

| Data Import | Seamlessly import last year’s tax data for continuity. |

| State Filing Support | Includes one state e-file; additional fees apply. |

Final Recommendations: Is TurboTax Home & Business 2023 Right for You?

Final Recommendations: Is It Right for You?

When deciding on tax software, consider your specific needs as a self-employed individual, independent contractor, freelancer, small business owner, or sole proprietor. If you fall into these categories, this option offers specialized features tailored to maximize your deductions and credits. It’s designed to identify industry-specific deductions, which can significantly enhance your tax savings. Furthermore, the ability to easily import prior tax information and create W-2s or 1099s for employees adds convenience, making it easier to manage your tax responsibilities. However, if you’re a simple filer or have straightforward tax needs, you might find the extensive features excessive. Additionally, keep in mind that while the software includes five federal e-files and one state download, additional charges apply for extra state e-filing. The free U.S.-based support can be a great asset if you encounter issues, but as with any software, the learning curve might require some time investment. Weighing these factors is crucial to determine if this software aligns well with your tax filing goals and personal circumstances.

| Pros | Cons |

|---|---|

| Maximizes Deductions: Tailored for small businesses. | Complexity: May be overwhelming for simple tax situations. |

| W-2 & 1099 Creation: Streamlined processes for employer forms. | Extra Fees: Additional costs for state e-filing. |

| Data Import: Easy import from previous filings enhances efficiency. | Learning Curve: Some users may face initial challenges. |

Customer Reviews Analysis

Customer Reviews Analysis

When it comes to tax preparation, TurboTax Home & Business 2023 Tax Software stands out as a top choice among users, particularly for self-employed individuals and small business owners. Let’s dive into the insights drawn from customer feedback on this powerful tax software.

Overall Satisfaction

Many users appreciate the efficiency and user-friendliness of TurboTax, citing its comprehensive features that simplify the filing process. With a blend of positive and cautious reviews, it appears that while the software excels in functionality, some users have faced challenges during installation or activation.

| Pros | Cons |

|---|---|

| Efficient and user-friendly interface | Installation issues reported by some users |

| Comprehensive tax features for small business | Difficulty with online activation for some users |

| Ability to handle industry-specific deductions | Limited online support for troubleshooting |

| Free audit defense included | State e-files sold separately |

| Quick and easy updates | Recovering information from previous versions can be challenging |

Key Features Highlighted

Reviewers frequently mention TurboTax’s ability to:

- Handle industry-specific deductions, which can be a game-changer for small business finances.

- Import information from previous tax years, significantly reducing preparation time.

- File W-2s and 1099s for employees and contractors, making it a one-stop solution for business taxation.

- Provide access for both Windows and Mac users with easy digital downloads.

Common Challenges

While many customers are satisfied with TurboTax’s functionality, some have reported:

- Frustration with the new online activation process and issues related to software compatibility on new systems.

- Difficulty in accessing timely customer support, particularly regarding installation and licensing problems.

- Concerns about being required to navigate through several steps for activation, which could disrupt an otherwise smooth experience.

Conclusion

TurboTax Home & Business 2023 Tax Software offers valuable tools and features for efficient tax filing. It seems to cater especially well to small business owners looking to maximize their deductions. However, potential users should be aware of some reported issues regarding activation and installation, which may require extra patience. From seamless updates to handling complex tax situations, those willing to tackle the installation process may find TurboTax a worthy investment in their financial journey.

Pros & Cons

Pros & Cons of TurboTax Home & Business 2023

When considering whether to invest in TurboTax Home & Business 2023, it’s essential to weigh the benefits against any drawbacks. Below is a comprehensive overview of the pros and cons to help inform your decision.

| Pros | Cons |

|---|---|

| Offers tailored deductions for self-employed individuals and small businesses. | State e-file is sold separately, which can add to the total cost. |

| Includes 5 federal e-files, making it easy to file for multiple income streams. | Some users may find the interface overwhelming if they are not tech-savvy. |

| Imports financial data from last year’s TurboTax or other tax software for a head start. | Requires a constant internet connection for support and updates. |

| Provides free U.S.-based support, which can be helpful for troubleshooting. | Can be pricey compared to other tax preparation options. |

| Comprehensive audit risk meter that helps identify potential errors before filing. | Some users may experience limitations with complex tax situations. |

| Regular updates with the latest tax laws ensure compliance and maximum deductions. | Requires downloading and storing data on your computer, which may concern some users regarding data privacy. |

TurboTax Home & Business 2023 is an excellent option for self-employed individuals and small business owners looking for a robust tax solution. However, being aware of the associated costs and potential complexities can help you make a more informed decision.

Q&A

Q&A Section: Unlock Your Tax Potential with TurboTax Home & Business 2023

Q1: Who is TurboTax Home & Business 2023 designed for? A: TurboTax Home & Business 2023 is tailored specifically for individuals who are self-employed, independent contractors, freelancers, small business owners, sole proprietors, and those operating a home office or home-based business. If you fall into any of these categories, this software is designed with your unique tax situation in mind!

Q2: What features does TurboTax Home & Business 2023 offer to maximize my deductions? A: This software is equipped with powerful features that search for hundreds of personal and small business deductions and credits. It includes an Audit Risk Meter that checks your return for audit triggers, provides industry-specific small business tax deductions, and simplifies asset depreciation and reporting. All these tools work together to help you identify every dollar you can claim.

Q3: Can I e-file my federal and state taxes using TurboTax Home & Business 2023? A: Absolutely! TurboTax Home & Business 2023 allows you to e-file five federal tax returns and one state tax return via download. However, please note that the state e-file option is sold separately.

Q4: Is there support available if I have questions while using the software? A: Yes, TurboTax offers free U.S.-based product support to assist you with any queries you might have while working through your taxes. The availability of support hours may vary, but rest assured that help is there when you need it.

Q5: Can I import my previous tax return information? A: Yes! TurboTax makes it easy for you to start your tax filing by allowing you to import information from your previous year’s TurboTax return or from other tax software. This feature can save you time and ensure accuracy as you file your taxes.

Q6: What types of forms can I create with TurboTax Home & Business 2023? A: You can create and e-file W-2s and 1099s for both employees and contractors using Quick Employer Forms, making it simpler to manage your payroll and contractor payments all in one place.

Q7: Will TurboTax Home & Business 2023 keep my data secure? A: Your downloaded TurboTax software resides directly on your computer, ensuring that your tax data is managed securely without needing to store it in the cloud. However, an Intuit Account is required to utilize the software.

Q8: How does TurboTax ensure I’m up to date with the latest tax laws? A: TurboTax Home & Business 2023 is continuously updated with the latest tax laws and regulations. This ensures that you have access to the most current information while preparing your tax return, helping you to file accurately and confidently.

Q9: What is the “Audit Risk Meter” feature? A: The Audit Risk Meter is a unique feature that checks your return for potential audit triggers. It helps identify aspects of your return that might raise red flags with the IRS, thus giving you peace of mind as you file.

Q10: How can I get started with TurboTax Home & Business 2023? A: Getting started is easy! Simply download the software from Amazon, install it on your PC or Mac, and follow the guided prompts to begin your tax preparation journey. With an intuitive interface and step-by-step instructions, you’ll be on your way to filing your taxes with confidence in no time!

Transform Your World

As we wrap up our exploration of TurboTax Home & Business 2023, it’s clear that this software is designed with the modern taxpayer in mind—especially those navigating the unique complexities of self-employment and small business ownership. With its robust features aimed at maximising deductions and minimizing headaches, TurboTax continues to stand out as a reliable partner during tax season. Whether you’re e-filing for the first time or looking to optimize your return with tailored advice, TurboTax provides a comprehensive solution that meets a variety of needs. Its user-friendly interface and proactive support ensure that you can dive into your tax filings with confidence, knowing you won’t miss out on any credits or deductions that could benefit your financial future. So why wait? Unlock your full tax potential and experience the ease of filing with TurboTax Home & Business 2023. Ready to take that step? Check it out here and empower your tax experience today!